In this article, we’ll cover everything you need to know about outsourcing financial services, including its benefits and drawbacks. We’ll also show you how to choose the right outsourcing service and how you can efficiently manage your outsourced staff. Overall, outsourcing can be a strategic decision that can deliver significant cost savings and operational efficiency improvements for financial firms. However, it’s important to approach outsourcing with caution and select the right partners to mitigate risks and ensure success. It’s worth noting that outsourcing can also present risks, such as loss of control over critical business functions and potential breaches of sensitive data.

Productivity management

Processes like accounting and supply chain finance management require tons of expertise and experience. That’s why many companies prefer to outsource them to a dedicated financial institution instead of putting inexperienced in-house staff on the job. HR outsourcing involves a business transferring its HR responsibilities to a third-party vendor. This can be done by outsourcing all HR functions or selectively outsourcing specific tasks. The vendor takes over HR tasks such as recruitment, payroll, benefits administration, employee relations and more.

Effective Ways To Manage Your Outsourced Financial Services Team

TCS, or Tata Consultancy Services, is the biggest Indian Information Technology (IT) outsourcing company and consulting service. A subsidiary of the Tata group, this IT consultancy and services firm operates in 46 countries like China, Belgium, and Poland. Founded by a US physician in Arizona, Hello Rache offers a virtual assistance solution for medical, dental, and veterinary professionals. It provides assistants who are trained in privacy policies and HIPPA guidelines. One of the biggest reasons why companies opt to outsource their service is to reduce costs. Outsourcing is the process where a business delegates certain non-core business process activities to a third party.

Onboarding Tools for Remote Teams: Enhance Your Hiring Process Today

This reduces the burden on internal staff and ensures customer inquiries are promptly addressed, enhancing customer satisfaction. By offering courses aligned with industry requirements, such as electronics, welding, and robotics, LATI ensures its graduates are well-prepared to meet employers’ needs. One key aspect of this approach is the development of customized training programs. Through business partnerships, academic institutions can design programs that directly address the skill gaps in specific industries. Upskilling enables organizations to close the digital talent gap by providing employees with the skills to fill these open positions.

- The U.S. is undergoing a significant demographic shift, with the 65-and-older population projected to nearly double over the next 30 years or 88 million by 2050.

- After analyzing the trial project, you should have a clear picture of the best outsourcing provider for your financial services.

- These platforms will be the much-needed lifeline you need to escape the long to-do list of financial tasks, allowing you to focus on what truly matters—growing your business.

- And don’t forget the time and expense involved to place classified ads, as well as interview, screen, test and train an employee.

From humble beginnings, the global outsourcing market has grown at a rapid rate as governments realize the economic benefits of providing services for other nations. This is particularly so in the accounting and bookkeeping sector, with several countries particularly invested https://www.accountingcoaching.online/objectivity-principle/ in nurturing such talent. Ensure that the outsourcing partner provides timely and accurate reports related to compliance with financial regulations. This diversifies risk and ensures that the failure of one provider does not lead to a complete halt in operations.

What is Financial Services Outsourcing?

Outsourcing an entire department or division in your business can lead to major efficiency gains. For successful team structures, local market recruitment advice and suggested staff to leader ratios, select one of the common teams that can be easily outsourced to the Philippines below. Keeping track of deadlines, exemptions, deductions, credits, and other tax-related matters can easily become a full-time job.

The third party can be dedicated outsourcing companies from your home (onshoring), a foreign country (offshoring), or individual freelancers. Many companies are handcuffed from potential growth as they balance increasing revenue generation and expenses. As modern leaders, they know that their competitive differentiator relies on their proactive decision-making, creativity, and analytical insight. I’ve had the great honor to lead Deloitte’s Women’s Initiative in New England. And I’ve enjoyed opportunities to share Deloitte’s journey with clients and others who are embarking on a similar journey themselves.

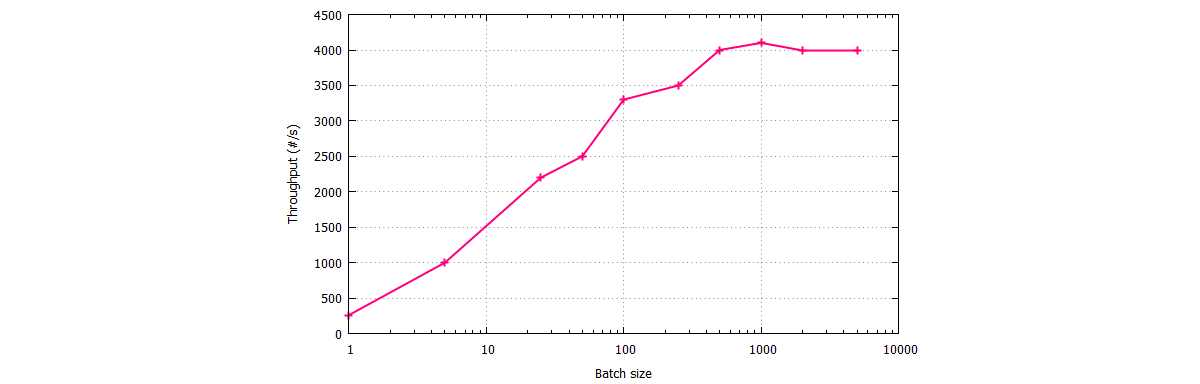

Features make a product, and users know the right features will boost productivity as well as create an overall experience, delivering value and functionality to the user. We looked for features based on the services each HR outsourcing provider had to offer. For example, mobile app capabilities, applicant tracking, payroll, reporting, reviews, learning management tools and more. If the features were included in the service, the platform received the highest score. If the features were an add-on, they received an average score and if the features were not included, they received no score. Workday is a full-suite, cloud-based software application providing HR, finance, planning and analysis management.

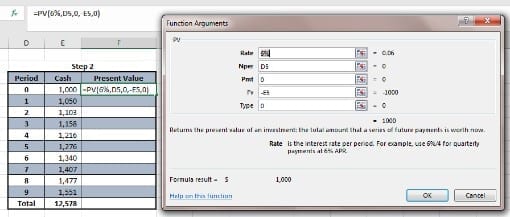

In this article, we will define the types of financial services you can outsource. We will also go deeper into the benefits and risks of letting a third party take care of financial duties. We will also give you some advice on how to outsource and the best practices to follow. Handing over bookkeeping to the experts not only ensures precision in your records but also provides you with a clear lens to view your startup’s financial health.

This could include everything from accounting and bookkeeping to investment management and risk analysis. Outsourcing allows financial services firms to focus on their core business functions while leaving non-core tasks to outside experts. Turnover, outdated systems, lack of talented in-house finance staff and inadequate budget to hire a strategic CFO can put the companies valuation at risk. Outsourced accounting service providers can customize their services, providing companies with only the financial services they need to fill their gaps.

Outsourced collections specialists assist in recovering outstanding debts and improving cash flow. They communicate with customers to negotiate payment arrangements and resolve billing disputes, helping businesses maintain healthy accounts receivable balances. The Philippines’ accounting industry is well-established, with the Philippine Institute of Certified Public Accountants (PICPA), founded in 1929, being one of the oldest accountancy institutions in Asia. Furthermore, its accounting standards align with those of Western countries as it adheres to the International Financial Reporting Standards issued by the International Accounting Standards Board (IASB). The United States is facing a shortage of accountants, with the average growth of accounting firms in 2020 being just 5.7%, the slowest in eight years. Meanwhile, retraining refers to updating existing skills to meet the changing demands of the job market or to transition into a different career or role.

In this case, gaining access to fractional or seasonal personnel can be an excellent alternative. Outsourced services could help your business leaders supplement existing resources and extend your reach by co-sourcing with internal audit on a project-by-project basis, by geography or by critical skills. Keeping an in-house team has its benefits, but one of them is https://www.quickbooks-payroll.org/ not cost savings. Wages and salaries are one thing, but consider other factors such as taxes, overheads, paid leave, and other employee benefits. This is the process of hiring an outside company to handle parts or the entirety of your business’s financial needs. Financial services is an umbrella term that covers a number of roles, tasks, and responsibilities.

Understand industry-specific regulations that impact financial services, such as banking regulations, securities laws, or insurance regulations. Companies can invest in language training programs for their teams and the outsourcing partner’s staff. This what is gross income ensures a shared understanding of financial terminology, reducing the risk of miscommunication. Clear contractual agreements should outline the responsibilities of both the outsourcing company and the service provider concerning regulatory compliance.