Cryptocurrency capital gains tax

SHIB is an Ethereum-based alternative to Dogecoin (DOGE), the popular and original canine-themed meme coin. As such, it’s compatible with the vast Ethereum ecosystem, including Ethereum wallets, is available on decentralised exchanges (or DEXs), and can be incorporated into ETH-based DeFi applications including lending and savings products and NFT marketplaces.< cool medical tattoos /p>

Let’s examine the data and its implications for the future of SHIB. Active addresses and profitability metrics. Sixty-two percent of SHIB holders are in the money according to recent data, which indicates a high degree of investor profitability. This translates into increased market confidence, particularly as price levels rise and active addresses become more involved.

Check out our .css-n840jb .css-n840jb *,.css-n840jb * > * .css-n840jb:hover,.css-n840jb *:hover .css-n840jb:focus,.css-n840jb *:focus SHIB Price Prediction page — when deciding on your own price targets. Data displayed are based on user input and not Binance’s opinion.

Inspired by Dogecoin but looking to surpass it in terms of utility, Shiba Inu came into existence with the intention of being more than a fun meme cryptocurrency. It has been designed with an ecosystem that includes ShibaSwap, its own decentralized exchange.

1. Set up a SHIB wallet: In order to receive the SHIB that you mine, you will need to have a Shiba Inu wallet to store it in. There are several options available, including software wallets that you can install on your computer and online wallets that you can access from any device with an internet connection.

Cryptocurrency bitcoin

In the blockchain, bitcoins are linked to specific addresses that are hashes of a public key. Creating an address involves generating a random private key and then computing the corresponding address. This process is almost instant, but the reverse (finding the private key for a given address) is nearly impossible. : ch. 4 Publishing a bitcoin address does not risk its private key, and it is extremely unlikely to accidentally generate a used key with funds. To use bitcoins, owners need their private key to digitally sign transactions, which are verified by the network using the public key, keeping the private key secret. : ch. 5

Unlike government-backed money, the value of virtual currencies is driven entirely by supply and demand. This can create wild swings that produce significant gains for investors or big losses. And cryptocurrency investments are subject to far less regulatory protection than traditional financial products like stocks, bonds, and mutual funds.

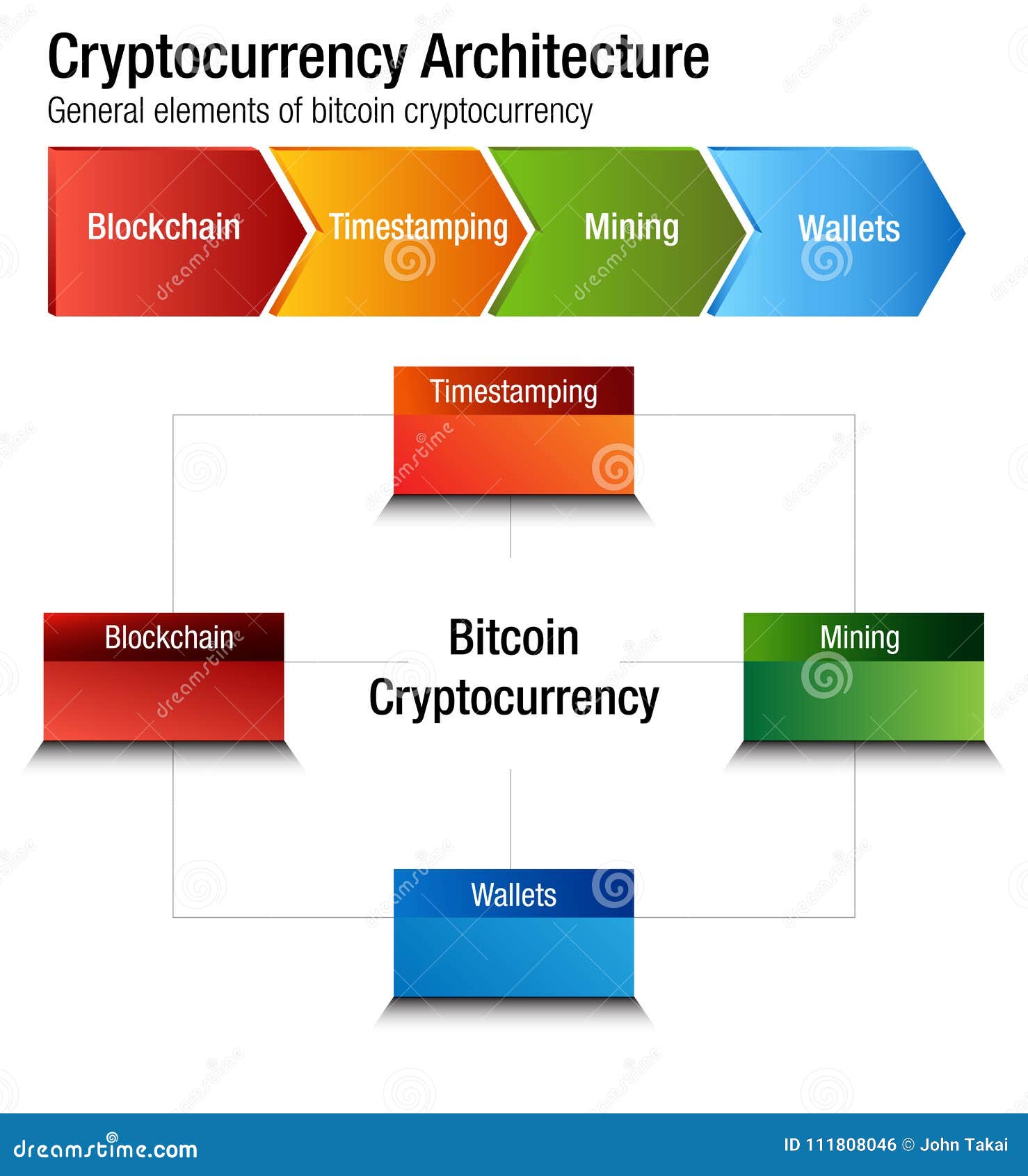

Cryptocurrencies are usually built using blockchain technology. Blockchain describes the way transactions are recorded into “blocks” and time stamped. It’s a fairly complex, technical process, but the result is a digital ledger of cryptocurrency transactions that’s hard for hackers to tamper with.

In the blockchain, bitcoins are linked to specific addresses that are hashes of a public key. Creating an address involves generating a random private key and then computing the corresponding address. This process is almost instant, but the reverse (finding the private key for a given address) is nearly impossible. : ch. 4 Publishing a bitcoin address does not risk its private key, and it is extremely unlikely to accidentally generate a used key with funds. To use bitcoins, owners need their private key to digitally sign transactions, which are verified by the network using the public key, keeping the private key secret. : ch. 5

Unlike government-backed money, the value of virtual currencies is driven entirely by supply and demand. This can create wild swings that produce significant gains for investors or big losses. And cryptocurrency investments are subject to far less regulatory protection than traditional financial products like stocks, bonds, and mutual funds.

Cryptocurrency stocks

Facebook parent Meta Platforms (META -0.7%) attempted to develop a new cryptocurrency called Diem (formerly Libra). Diem was envisioned as a global financial payment and infrastructure platform accessible to everyone, including almost one-third of the global population without bank accounts.

Digital currencies are highly volatile and not backed by any central bank or government. Digital currencies lack many of the regulations and consumer protections that legal-tender currencies and regulated securities have. Due to the high level of risk, investors should view cryptocurrency as a purely speculative instrument.

Robinhood can combine its commission-free model with scaling the number of cryptocurrencies on the platform, gaining a massive competitive advantage over both traditional and decentralized exchanges. The company also could offer the same crypto analytics services as Coinbase to further promote trust in the sector and boost its adoption.

Facebook parent Meta Platforms (META -0.7%) attempted to develop a new cryptocurrency called Diem (formerly Libra). Diem was envisioned as a global financial payment and infrastructure platform accessible to everyone, including almost one-third of the global population without bank accounts.

Digital currencies are highly volatile and not backed by any central bank or government. Digital currencies lack many of the regulations and consumer protections that legal-tender currencies and regulated securities have. Due to the high level of risk, investors should view cryptocurrency as a purely speculative instrument.

Robinhood can combine its commission-free model with scaling the number of cryptocurrencies on the platform, gaining a massive competitive advantage over both traditional and decentralized exchanges. The company also could offer the same crypto analytics services as Coinbase to further promote trust in the sector and boost its adoption.