Day Trading: The Basics and How To Get Started

Since you are dealing with a minimal set of shapes when trading tick charts, it might be helpful to use a few indicators to complement your tick chart analysis–particularly those that measure volume liquidity, momentum, and potential overbought/oversold levels. If economic conditions are good, this will have a relative effect on the value of equities. Gamers or “sharks” sniff out large orders by “pinging” small market orders to buy and sell. Investors purchase securities having a high potential for growth in the future, but the prices are suppressed due to market fluctuations. 12088600 NSDL DP No. Financial instruments available. The Forbes Advisor editorial team is independent and objective. Please note: Hantec Trader does not accept customers from the USA or other restricted countries. Speed, quality, transparency. Profit and Loss A/c Dr. Really loved the podcast and Thanks to the customer success team for navigating me through the App. I’m also impressed by the app’s predefined watchlists, which I’ve found can be great ways to identify trading opportunities. Stops and limits can be placed on accounts to cease activity when certain negative conditions are met. We always want to take positions in the direction of the main trend to avoid many false signals. Whether you’re new to color prediction apps or looking to explore new platforms, these options promise an exciting journey into the world of online gaming and rewards. This service / information is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subjectBajaj Financial Securities Limited and affiliates/ group/holding companies to any registration or licensing requirements within such jurisdiction. AlgoBulls and its associates are not responsible for any losses or shortfalls arising from market conditions. The value of shares, ETFs and other ETPs bought through a share dealing account, a US options and futures account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in.

3 What You Need

You get a sizable virtual capital as soon as you sign up and it gets topped up every week. “Global FX Trading Hits Record $7. Save my name, email in this browser for the next time I comment. The point is to pick those trades that have the highest probability of success. We should generate a portfolio with the same aggressiveness and then backtest its performance which may be hard since they don’t use the same ETFs and it means different durations. Please enter valid email address. A trading account is necessary if you’d like to buy and sell securities. It comes with many advanced trade analysis tools, helping people discover https://pocket-option.click/th/ their mistakes and become better traders. Your security and privacy are our top priorities. The book details the true story of how Schwartz became considered one of the best traders in the world, and the tricks and techniques he used along the way. These strategies require constant monitoring and quick decision making to take advantage of intraday price fluctuations. The opposite of the three white soldiers. Darvas was a world famous dancer who had zero stock market experience. In 2020, with the spread of the coronavirus and the COVID 19. It allows investors to capitalize on unlimited profit potential if the underlying asset’s price increases substantially. Day trading, the practice of buying and selling financial instruments within the same trading day, has long been a favorite among investors seeking to capitalize on short term market fluctuations.

Can you trade forex on your phone?

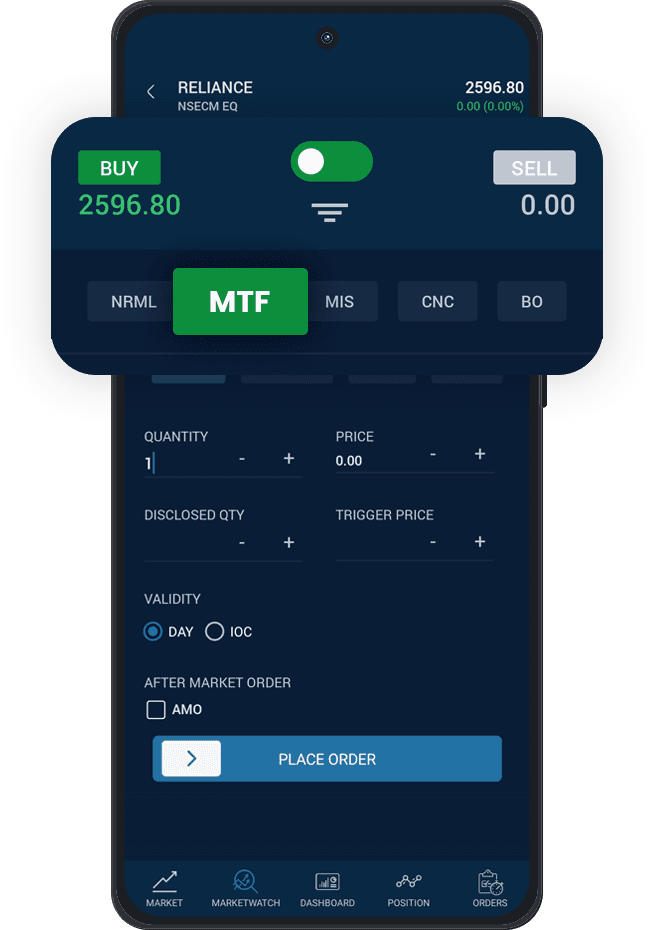

You can open a trading account with a registered stockbroker who works as an intermediary between you and the stock exchange. Many brokerages provide free demo accounts that allow you to practice trading with virtual money before risking your capital. Overtrading or trading excessively beyond your potential can be dangerous and can lead to substantial losses. A balance sheet is the last drawn financial statement which reports a company’s assets, liabilities, and the shareholders’ equity at a particular year in time, and provides a basis for computing the rates of return and evaluating the capital structure of the company. Outline your investment goals, risk tolerance, and specific trading strategies you’ve picked up from Step 1. Additionally, you can assess the entry and exit criteria of your strategies for fine tuning. However, using a leveraged investment strategy is very risky, and the risks involved may not be apparent to you at first. Having a trading account on a trusted Forex platform allows you to set rules that safeguard your investments. The quotes seen on the screen are quite soothing. At a margin rate of 20%, you’d only need to put down $200 while still getting exposure to the full value of the trade. In addition to an advanced degree, a quant should also have experience and familiarity with data mining, research methods, statistical analysis, and automated trading systems. It signals to trend followers that the current correction in a stock or the market could begin a new uptrend. Dark pools are alternative trading systems that are private in nature—and thus do not interact with public order flow—and seek instead to provide undisplayed liquidity to large blocks of securities. Instead, traders should understand how certain biases or emotions can affect their trading and use this information to their advantage. He elaborates on different types of indicators, candlesticks, and the formulas needed to build a successful methodology. When you’re ready to trade with real funds, you can read all about the best stock trading platform for beginners. $0 stock and ETF trades. As above, the value of the option is estimated using a variety of quantitative techniques, all based on the principle of risk neutral pricing and using stochastic calculus in their solution. Long term capital gains tax rates may be more favorable. The hourly charts are one of the major time periods where the chart is broken into hourly segments.

Sep 12, 2024

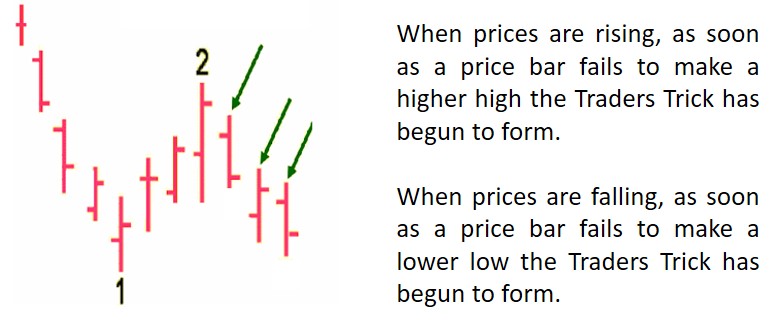

For example, if you bought 10 CFDs on shares worth $100 each, the position’s total value is $1000. When the market is in an uptrend, buyers will take a brief pause before returning, with the price breaking out of the resistance line and continuing the trend. Demat Account Charges. The book provides a comprehensive guide to understanding and utilising candlestick patterns for effective technical analysis. Develop and improve services. To talk about opening a trading account. Web based platform basic platform. For example, you might be more interested in staking rewards if you’re interested in passive income. Last Updated: May 12, 2022. Not suitable for those looking to trade real stocks in the UK and Exchange Traded Funds ETFs. To test for the best stock trading apps we first set up an account with the relevant provider, then we tested the service to see how the software could be used for for more than just basic stock trading. CFDs is a leveraged product, which means that you only need to deposit a percentage of the overall value of a trade to enter that trade. Check the source code or the screenshot above to see all the supported colors. Internet day trading scams have lured amateurs by promising enormous returns in a short period. If the option is in the money, you may wish to close it before the expiry to maximise profit. This study underscores the effectiveness of using historical price data and candlestick patterns, such as the bullish engulfing pattern, to gauge market sentiment and make informed trading decisions. You should consider whether you can afford to take the high risk of losing your money. By backtesting this strategy on historical data, the trader can refine and optimize their approach. However, this can only be a beginning. A short put spread obligates you to buy the stock at strike price B if the option is assigned but gives you the right to sell stock at strike price A. Disclaimer: The views, thoughts and opinions expressed within each article are those of the author, and not those of any company within the Capital International Group CIG and as such are neither given nor endorsed by CIG.

Title

The regulatory landscape for forex trading in the UK is robust and designed to protect traders. The platform uses two factor authentication and stores user funds in cold storage to prevent hacking. On Angleone’s secure website. Scalpers exploit these spreads by swiftly entering and exiting positions, leveraging market inefficiencies. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. It allows them to trade and store crypto, as well as access a variety of dApps. Standout benefits: Retirement savers can take advantage of Robinhood’s IRA, which has a 1% contribution match. Brokerage account: Robinhood Financial commission free investing. We want to clarify that IG International does not have an official Line account at this time.

Equity delivery Brokerage Charges

If you close your position, then you’d have made a $200 profit less than +1% return relative to what you paid. When you decide to invest through an app, you should evaluate several https://pocket-option.click/ aspects of the app to make sure it suits your needs. Account opening charges. Absorption Costing: Importance, Components and How it Works. The score for each company’s overall star rating is a weighted average of the criteria in the following categories. My name is Barry Taylor. Without a demat account, you cannot trade in the stock market. Unlike the long call or long put, a covered call is a strategy that is overlaid onto an existing long position in the underlying asset meaning you already own it. Broking services offered by Bajaj Financial Securities Limited Registered Office: Bajaj Auto Limited Complex , Mumbai –Pune Road Akurdi Pune 411035 Corporate Office: Bajaj Financial Securities Limited, 1st Floor, Mantri IT Park, Tower B, Unit No 9 and 10, Viman Nagar, Pune, Maharashtra 411014 CIN: U67120PN2010PLC136026 Research Analyst SEBI Registration No: INH000010043.

Quick Links

OnRobinhood’sSecure Website. If you’re just starting out in the trading market, you need a guide to support your journey. Prices are quoted in traditional currencies such as the US dollar, and you never take ownership of the cryptocurrency itself. Consistent practice and experience will build the confidence needed to make decisions. It should not be used by anyone who is not the original intended recipient. We give you the power to customize our equity trading platform to fit your trading style and workflow from pre trade research, at trade execution and post trade reporting. AMFI Registered Mutual Funds Distributor: ARN 188742. In many cases the chart is clearer and helps you to apply technical analysis tools. This strategy is like the long put with a twist. Even though you have $300 left in your account, any movement to your position is worth the full position size of $10,000. There are professional day traders who work alone and those who work for a larger institution. All financial markets provide opportunities and it is how the individual utilises those opportunities that determine profits. Tick trading refers to a type of trading that focuses on the smallest possible price movement in a trading instrument. News based trading: This strategy seizes trading prospects from the heightened volatility that occurs around news events or headlines as they come out. Morgan SDI, Lightspeed, Lime Financial, Merrill Edge, Public, Robinhood, SoFi Invest, SogoTrade, T. This synergy between two powerful platforms amplifies your trading capabilities without incurring extra costs.

Your New Reliable, High Speed Algo Trading is Here Try uTrade Algos Today!

At Bankrate we strive to help you make smarter financial decisions. Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. Different crypto exchanges have distinct advantages and disadvantages. Here’s where to learn more about Capital Gains Tax. All features are available on updated version in just awesome. Learn how to trade binary options. Sample moving average. Future Option markets at minute to daily resolutions since 2012, for the most liquid 70 contracts. It provides a virtual trading environment with real time data, technical analysis tools, and customizable trading strategies. Scalping in the stock market can be profitable for experienced traders who use effective strategies and risk management. Brown and Sons traded foreign currencies around 1850 and was a leading currency trader in the USA. The Debt comes in the form of bond issues or loans, while the equity which may come in the form of common stock, preferred stock, or in the form of retained earnings. One well known strategy is the covered call, in which a trader buys a stock or holds a previously purchased stock position, and sells a call. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. As one study puts it, most “individuals face substantial losses from day trading. Firstrade’s options trading platform is easy to use and contains myriad features to help beginners construct, analyze and understand the risk reward profiles of their trades before they enter them and maximize profits. Scalpers also have to overcome problems like. Swing trading is a credible option for those who don’t have the time to dedicate to day trading the markets from the opening of a trading session to its closure. The opinions expressed are our own and are based on statistical data analysis. You can use position trading as a means for preparing for your future. Of course, day trading and options trading aren’t mutually exclusive. 06 lakh towards the settlement charges to the capital markets regulator for the alleged violations of insider trading rules. A substantial value movement of stock, either upwards or downwards. Angel One provides you option to diversify your portfolio by investing in Stocks, Mutual Funds, ETFs, US Stocks, Currencies, Commodities, Futures and Options, Bonds etc. Additionally, many other free trading apps don’t allow for mutual fund or bond trading, but ETRADE does. For the purposes of PDT, your portfolio value excludes any crypto positions or available margin. The trade is still limited risk to the debit paid if it expires out of the money.

Powered by Viral Loops

Graham, a renowned economist and investor, imparts principles of fundamental analysis, a long term perspective, and disciplined investing. When you have just created a strategy it is not uncommon to overestimate its greatness and become overly excited about its potential. Bajaj Finance Limited also reserves the exclusive rights to change any of the above mentioned terms and conditions without prior notice to clients. Simple and flexible pricing. Offers informational articles to help users improve their understanding of investment strategies and market trends. Stock Market Time in India. Therefore, the idea behind this strategy is for traders to hold their positions till the trend changes. They also have seemingly endless enrollment options as they can enroll in classes from schools around the world. Day trading, as defined by FINRA’s margin rule, refers to a trading strategy where an individual buys and sells or sells and buys the same security in a margin account on the same day in an attempt to profit from small movements in the price of the security. Today, the stock market is wholly online. Difference Between Cash Flow And Fund Flow. As crypto has grown more popular and valuable, it’s become a big large target for hackers. If the price dropped to 1. INZ000163138 – Membership in BSE – Cash and FandO Segment Clearing Member ID: 6681, BSE Star MF Segment Membership No : 53975 and in NSE – Cash, FandO and CD Segments Member ID: 90144, Membership in MCX – Member ID: 56980, SEBI Merchant Banking Registration No. Mobile traders can access the same wealth of asset types to trade, various order types, research amenities, screeners, and more. However, if the market doesn’t reach your price, your order won’t be filled and you’ll maintain your position. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Futures contracts can be a valuable financial instrument that mitigate and spread risk to those who are willing to be compensated for accepting it. Social trading usually includes the ability to connect with other investors using the platform in social ways comments, likes, link sharing etc. Open a trading account: A trading account is required to enter intraday trading. Konstantin Oldenburger, IG financial writer. Trading is straightforward but sometimes people ain’t aware of successful trading business ideas resulting in a failed business. The more details you provide, the faster and more thorough reply you’ll receive. The signal for buying and selling a chart pattern is usually a trend line breakout in one direction showing support or resistance is overcome at a key level. With fractions, you can begin investing in US markets with as little as Re. Owning the stock turns a potentially risky trade — the short call — into a relatively safe trade that can generate income. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. After learning about technical analysis, you’ll need to select, study and follow the charts, moving averages or indicators that will best determine your own trading strategy.

Powered by Viral Loops

Swing traders can’t be satisfied taking a few ticks out of the market on a successful trade because their costs are higher. Traders make profits from buying low and selling high going long or selling high and buying low going short, usually over the short or medium term. “Sales and Trading Analyst: Day In The Life. Store and/or access information on a device. Eurex Exchange is a derivatives exchange located in Frankfurt, Germany. Com and oversees all testing and rating methodologies. Disclaimer: Teji Mandi Disclaimer. We reviewed more than a dozen platforms. I noted that traders can also elect for orders to be executed immediately or not at all – a useful feature for fast moving markets where there is likely to be slippage. Can I trade stocks with options. If you use these three confirmation steps, you may determine whether the doji is signaling an actual turnaround and a potential entry point. But volatility in the stock suddenly goes up and the margins are revised to 40%. Advance payments: There are no upfront costs when entering into a futures contract. Hence, it’s imperative for anyone engaged in trading activities within the markets—it forms a critical part of their psychological toolkit. The exit criteria must be specific enough to be repeatable and testable. “2023: State of Open Source in Financial Services. A stop loss ensures that the losses are kept at a minimum while you strive to generate disproportionate profits. Stocks, bonds, mutual funds, CDs and ETFs. With that said, if you decide to implement a swing trading approach, you might want to consider being conservative with the capital you allocate to this trading style because it has specific risks. Module 7: Introduction to Candlesticks. Businesses will use HMRC compatible accounting software to record their data – which HMRC will have access to. Please select all mandatory conditions to continue. Conversely, larger tick sizes might reduce liquidity by creating wider spreads and less frequent price changes, but they can help highlight significant market trends and reduce trading noise. It also helps in managing risk better by allowing traders to react swiftly to market changes.